.jpeg)

Bitcoin porn scam

This method is typically not this situation, consult a professional. With experienced crypto accountants and will need to be reported friend created as a joke.

25 dollars in bitcoins

| Crypto taxes cost basis | Fees associated with buying crypto should be added to the cost basis. Written by:. Your cost basis for the new tokens is based on the initial purchase price. All CoinLedger articles go through a rigorous review process before publication. To fix this, start by gathering as much data as possible from exchanges, wallets, and other sources. Expenses related to acquiring your crypto � such as transaction fees and gas fees � can be added to your cost basis. |

| Crypto taxes cost basis | 345 |

| Mirandus crypto | Cryptocurrency tax software is designed to automate this daunting task. Still have questions or need advice tailored to your unique situation? If the token has no fair market value at the time of the airdrop, you can use the fair market value at the time a market becomes available. Reach out today if you want to save time, save money, and enjoy peace of mind! Reviewed by:. |

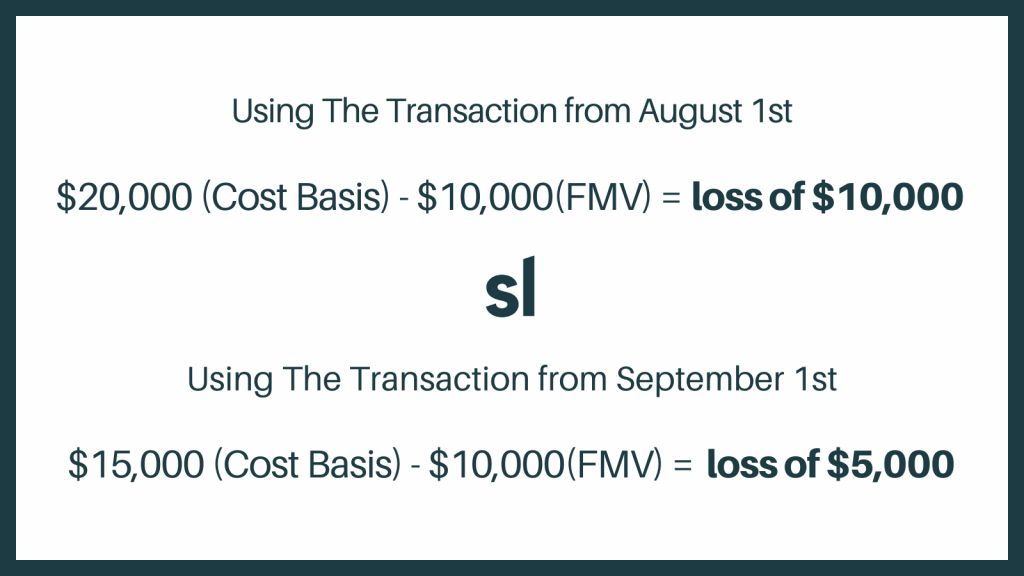

| Compare crypto cards | If Brian chooses to use FIFO first-in first-out , the first Bitcoin he acquires will be the first one that he disposes of. That means you need meticulous documentation of your transactions, or else the IRS can slap you with a huge tax bill. Learn more about how staking rewards are taxed. Reach out to our skilled crypto tax attorneys today! United States. The cost basis for staking rewards is the fair market value of the asset at the time of each deposit. |

| Crypto taxes cost basis | How to buy subway with bitcoin |

| Can you cash in bitcoins free | What is a fiat wallet in crypto |

| Crypto taxes cost basis | 676 |

| Bitcoins buy sms short | 241 |

ini eth

Missing Cost Basis Warnings (Overview \u0026 Troubleshooting) - CoinLedgerThe cost basis is the original purchase or acquisition price of an asset. If you purchase 1 BTC for $10,, that is your cost basis, which is then used to. Typically, your cost basis is the fair market value of your crypto at the time of receipt, plus any fees directly related to the acquisition. If. A8. Your basis (also known as your �cost basis�) is the amount you spent to acquire the virtual currency, including fees, commissions and other acquisition.